In the world of investing, it’s easy to focus on what you can see and touch. Factories churning out products, stores packed with inventory, piles of cash on the balance sheet – these are the things that have traditionally defined a company’s assets.

But in today’s fast-paced, innovation-driven economy, there’s a less visible class of assets that are proving just as important, if not more so. These are called intangible assets, and while you can’t see or touch them, they’re the secret sauce behind many of the world’s most successful companies.

The Power of Ideas, Brands, and People

So, what exactly are intangible assets? Simply put, they’re the non-physical things that give a company its edge. Think about it like this:

– It’s the unique technology that powers TikTok’s video feed

- It’s the beloved characters and stories that keep Disney fans coming back

- It’s the design savvy and user-friendly features that make Apple products so popular

- It’s the wealth of customer data that helps Amazon target its offerings and keep shoppers loyal

In other words, intangible assets are the ideas, the brands, the talent, and the relationships that set a company apart from the pack.

The Trouble with Traditional Valuation

Current accounting standards require companies to report physical assets like factories and trucks on their balance sheets, but do not mandate similar disclosure for intangible assets common in the new economy, such as intellectual property, data, or brand value. In fact, when a company invests in creating new software or training its employees, it actually looks like they’re losing money in the short term.

This can make it hard to accurately judge the value of companies that rely heavily on intangible assets. If you only look at traditional measures like profits and physical assets, you might miss out on the huge potential of these asset-light, knowledge-based companies.

Contextual Stock Selection in Absolute Return Strategies

At Bridgeway, we understand that in today’s economy, you need a new playbook for picking stocks. That’s why we’ve developed a unique approach that helps us spot the hidden value in intangible assets in our absolute return stock selection models.

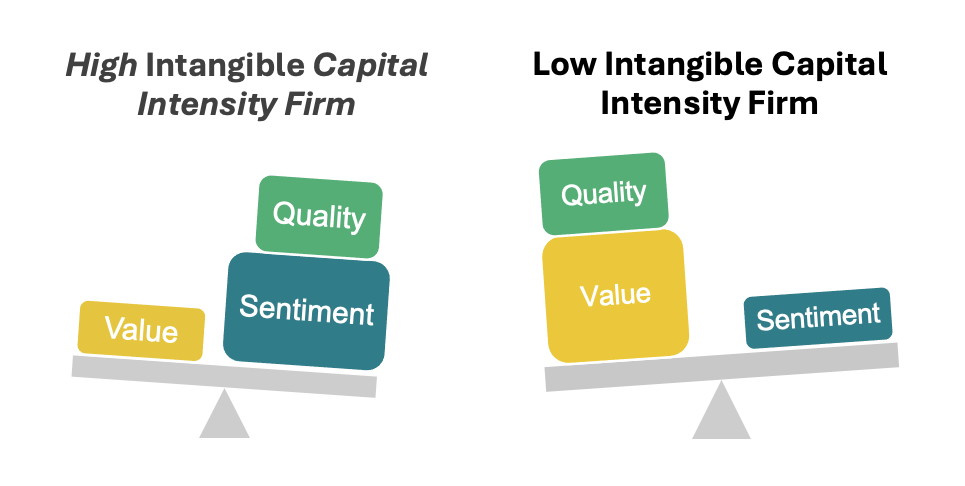

We start by dividing industries into two groups based on Intangible Capital Intensity. For the New Economy industries which include “High Intangible Capital Intensity” companies, we look beyond the financial statements to emphasize market sentiment that isn’t priced into the stock price. For the Old Economy industries which include “Low Intangible Capital Intensity” companies, we emphasize the tried-and-true methods of analyzing profits, cash flow, and physical assets.

By using this two-pronged approach, we’re able to find promising investment opportunities that others might overlook based on old-fashion valuation methods.

Investing in the Intangible Future

As the world becomes increasingly driven by knowledge, innovation, and brand power, we believe that understanding the impact of intangible assets on stock selection will be key to successful investing.

At Bridgeway, our unique perspective allows us to navigate this new landscape and build absolute return portfolios that we believe are positioned to thrive in the intangible economy. By seeing the potential in ideas, people, and relationships, we aim to unlock value that others might miss.

Additional Readings

- Dugar, A., & Pozharny, J. (2021). Equity investing in the age of intangibles. Financial Analyst Journal, March 2021.[Equity Investing in the Age of Intangibles | CFA Institute Research and Policy Center]

- Berkin, A. L., Dugar, A., & Pozharny, J. (2022). The impact of intangible capital on factor performance efficacy. Journal of Portfolio Management, July 2022. [The Impact of Intangible Capital on Factor Performance Efficacy | Portfolio Management Research]

- Berkin, A. L., Dugar, A., & Pozharny, J. (2024). Classical stock valuation in the modern era of intangibles. Journal of Investing, June 2024. [Classical Stock Valuation in the Modern Era of Intangibles | Portfolio Management Research]

DISCLOSURE

The opinions expressed here are exclusively those of Bridgeway Capital Management (“Bridgeway”). Information provided herein is educational in nature and for informational purposes only and should not be considered investment, legal, or tax advice.

Investing involves risk, including possible loss of principal. In addition, market turbulence and reduced liquidity in the markets may negatively affect many issuers, which could adversely affect investor accounts.

Diversification neither assures a profit nor guarantees against loss in a declining market.