The emerging markets category comprises dozens of countries with unique financial, political, and geographic conditions that can affect local stock performance. Because of these variations, investors need a reliable way to monitor overall conditions in the emerging markets landscape as a starting point for a deeper, multi-faceted analysis.

P/B-ROE analysis is a classic methodology to provide this overview. First described more than 30 years ago by Jarrod Wilcox, the Price-to-Book/Return on Equity (P/B-ROE) model is typically used to measure how cheap or expensive a company’s assets are relative to its level of profitability. Bridgeway has adapted this model to provide an aggregate view across MSCI Emerging Markets Small Cap Index country constituents. By measuring the median book yield (the inverse of price-to-book), ROE, and year-over-year returns for each country’s small-cap stocks, we can begin to understand country-level tradeoffs between valuation and profitability that investors might face in the emerging markets small-cap universe.

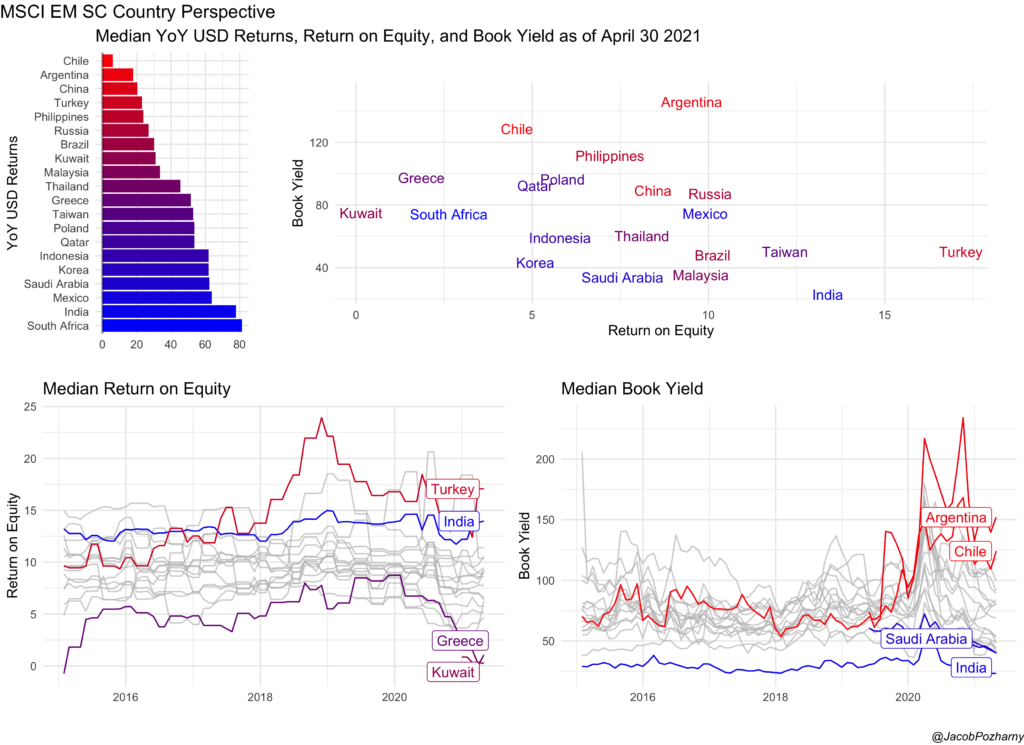

This chart highlights conditions in the emerging markets small-cap landscape as of April 30, 2021.

- The y-axis plots each country’s book yield, placing cheaper countries higher on the chart

- The x-axis plots return on equity, placing more profitable countries farther to the right

- Country names are color-coded according to the median year-over-year returns for EM small-cap stocks. Countries in red have the lowest median returns, while countries in blue the highest.

Source: FactSet

Based on the P/B-ROE model, we expect a generally linear relationship between profitability and valuation: Investors typically are willing to pay higher prices for higher profitability while driving prices down for countries with lower profitability. We see that relationship in April among the countries grouped near the center of the chart.

What’s particularly useful for investors, though, is to note the outliers—countries whose placement isn’t in line with the model’s expectations for valuation and profitability. This analysis highlights conditions in those countries that represent potential risks and opportunities.

Lower profitability or valuation

- Greece is among the least expensive and least profitable countries. Greece historically has had below-average ROE (as shown above in the Median Return on Equity chart on the bottom left), while Kuwait – the least profitable country on the chart – has only been in the index a short time. It remains to be seen whether Kuwait will continue to be among the least profitable with a valuation that is in the middle of its country peers.

- Chile and Argentina stand out as two major outliers, given that their valuations appear much cheaper than we’d expect given their ROE. One potential reason is that both countries are experiencing recent surges in COVID-19 infections, creating uncertainty about the future (Argentina’s health system, for example, was recently reported to be on the brink of collapse). Investors’ concerns appear to be reflected in those countries’ valuations.

Higher profitability or valuation

- Turkey and India are both highly profitable and expensive—a trend we see stretching back several years. India has been able to maintain high profitability over the last year due to the government’s unwillingness to impose an economic lockdown because of the pandemic.

- But each country faces potential risks in the future. Turkey’s political climate is creating volatility in its currency prices and inflation. Likewise, India’s historically high profitability and high valuations may be under pressure due to that country’s recent COVID surge. If India goes into lockdown to help contain the virus, investors should expect to see an impact on both prices and profitability—with India potentially following the trajectory we saw in Argentina and Chile.

Investor Sentiment

Median year-over-year returns – represented by the bar chart above on the top left – can be a useful proxy for investor sentiment for each country, offering investors further context in addition to the PB/ROE analysis.

- South Africa has the highest median year-over-year return despite having among the lowest profitability and a middle-of-the-pack valuation among MSCI Emerging Markets Small Cap member countries. This could potentially be explained by South Africa’s concentration in commodity production, which has been bid up by global fears of inflation due to expansion in global money supply to overcome the effects of economic lockdowns during the pandemic.

- Chile and Argentina have the lowest median year-over-year returns. Like each respective country’s valuation, returns have been affected by COVID-19 impacting economic prospects. Also among the lowest median year-over-year returns despite middling valuation and profitability, China has experienced political instability in Hong Kong and has suffered from the trade war with the US.

We don’t recommend making investment decisions solely on the inputs of valuation, profitability, or sentiment. Bridgeway’s own Emerging Markets Small-Cap Equity Strategy uses a much more detailed, multi-layered investment process to help determine exposures and holdings. However, we believe this analysis gives investors valuable context for how local conditions and events can alter the emerging markets small-cap investment landscape over time.

DISCLOSURE

The opinions expressed here are exclusively those of Bridgeway Capital Management (“Bridgeway”). Information provided herein is educational in nature and for informational purposes only and should not be considered investment, legal, or tax advice.

Past performance is not indicative of future results.

Investing involves risk, including possible loss of principal. In addition, market turbulence and reduced liquidity in the markets may negatively affect many issuers, which could adversely affect client accounts. Value stocks as a group may be out of favor at times and underperform the overall equity market for long periods while the market concentrates on other types of stocks, such as “growth” stocks. Emerging markets are those countries that are classified by MSCI as emerging markets and generally consist of those countries with securities markets that are less sophisticated than more developed markets in terms of participation, analyst coverage, liquidity, and regulation. These are markets that have yet to reach a level of maturity associated with developed foreign stock markets, especially in terms of participation by investors. These risks are in addition to the usual risks inherent in U.S. investments. There is the possibility of expropriation, nationalization, or confiscatory taxation, taxation of income earned in foreign nations or other taxes imposed with respect to investments in foreign nations, foreign exchange control (which may include suspension of the ability to transfer currency from a given country), default in foreign government securities, political or social instability, or diplomatic developments which could affect investments in securities of issuers in those nations. The government and economies of emerging markets feature greater instability than those of more developed countries. Such investments tend to fluctuate in price more widely and to be less liquid than other foreign investments. Investments in small companies generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of reasons, including the relatively limited financial resources that are typically available to small companies, and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile and less liquid than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn.

Diversification neither assures a profit nor guarantees against loss in a declining market.

P/B-ROE are financial measures referring to the price-to-book (P/B) ratio and return on equity (ROE) of a company.

The MSCI Emerging Markets Small Cap Index includes small-cap representation across 27 Emerging Markets countries. With 1,692 constituents, the index covers approximately 14% of the free float-adjusted market capitalization in each country. The small-cap segment tends to capture more local economic and sector characteristics relative to larger Emerging Markets capitalization segments.

One cannot invest directly in an index. Index returns do not reflect fees, expenses, or trading costs associated with an actively managed portfolio.