After a year of uncertainty, historical data suggests looking to the smallest stocks for full exposure to the small-cap premium

With well over 50 combined years of investment experience, we’ve both lived through some monumental world events in our careers. Even with that perspective, it’s still hard to fully comprehend the events of 2020. The global impact of the Covid-19 pandemic, both financially and health-wise, was truly unprecedented. From our headquarters in Houston to Central Africa, where the Bridgeway Foundation performs some vital work, we’ve seen few lives untouched by what has unfolded. Having said that, the business of investing for pensions, insurance companies, foundations, endowments, and individuals must continue. The assets we are privileged to steward at Bridgeway perform vital functions like paying pensions and life insurance settlements, funding philanthropic work, and providing for individual retirees in their golden years. So, despite the challenges we’ve all faced during the pandemic, Bridgeway continues to focus on this critical work, while also funding organizations serving those in need.

From an investment perspective, the shock to markets in Q1 2020 was followed by an equally astounding whipsaw recovery and rally. Now, well into Q1 2021, we see the broad market at new highs nearly every day. Growth stocks have outperformed value stocks for the past 10 years, and large caps still outpace small caps over the decade, despite strong returns for small-cap stocks in Q4 2020. As in previous periods of uncertainty and anxiety, like the 2000 Tech Bubble and the 2008-2009 Global Financial Crisis, we are regularly asked about markets, sectors, earnings, inflation, and other financial concerns. But the real question behind most of these questions boils down to the same thing: “Where do we see opportunities to invest?”

Although we certainly see several attractive areas, US small-cap stocks appear to be poised for a potential once-in-a-decade opportunity. As contrarians and practitioners of factor-based investing, our optimism on US small-cap stocks should be no surprise given their most recent decade-long underperformance relative to US large-cap stocks. Many investors are aware that over long periods, small caps have outperformed large caps (the small-cap premium)—but this hasn’t been the case for the past decade. We believe this presents a compelling opportunity in terms of reversion to long-term levels.

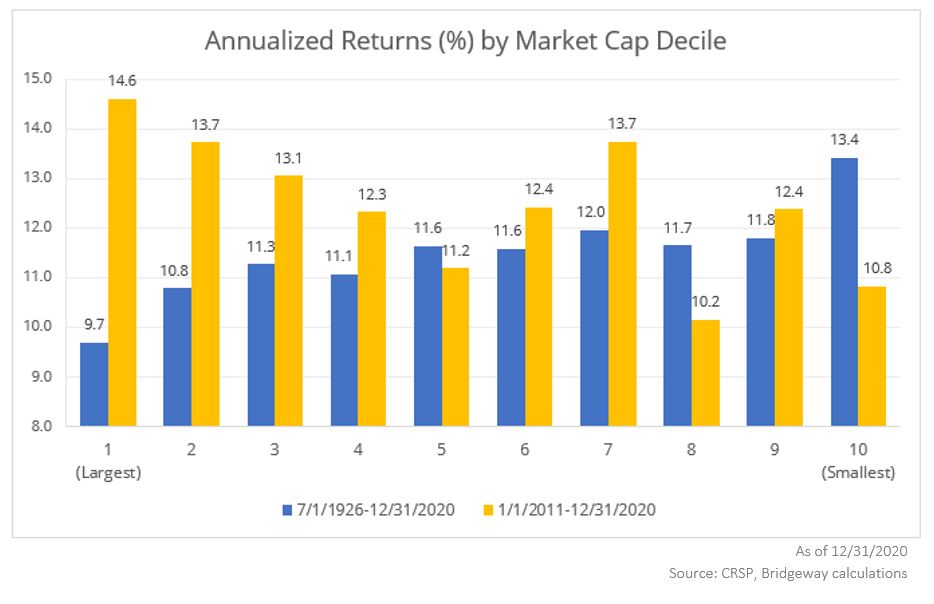

While US small-cap stocks present an attractive opportunity, we are especially excited about the “ultra-small” portion of the US small-cap market; at Bridgeway, we define these companies as “the smallest-of-small caps.” To make the case succinctly, the following chart reflects performance data going back to 1926 for stocks in different market caps, compiled by the Center for Research in Security Prices (CRSP).

As you can see from the CRSP data, the smallest decile of publicly traded US companies (CRSP 10) have a nearly century-long track record of outperformance relative to the largest, mega-cap firms (CRSP 1). Contrast that with the last decade (as represented by the yellow bars above), which has seen this smallest decile of companies lag their largest counterparts by nearly four percent on an annualized basis. As ardent contrarians, this dislocation between large and ultra-small stocks over the past 10 years shouts “Big Opportunity” because historically, after dramatic periods of underperformance, we regularly see a reversion to long-term levels.

And while we think the ultra-small segment of the market is especially attractive now, we saw this opportunity years ago and began buying ultra-small stocks in the early 1990’s. Understanding that this opportunity could be attractive to institutional investors, we launched our first strategy focused on this segment in 1994. The investment thesis then, as now, was to build a portfolio focusing primarily on the CRSP 10 portion of the market to capitalize on the premium offered there.

Today, just like in 1994, another BIG reason we think US ultra-small stocks are a great opportunity is because so few investors, especially institutions, allocate here. It’s a hole in most portfolios, and frankly, this omission is perplexing. When we recently reviewed allocations of some large public pension funds, we observed allocations to Eastern European private equity, emerging markets infrastructure, and a commitment to Latin American private credit, to name just a few. While we applaud these investors’ efforts to diversify returns, we also find it head-scratching that many investors have overlooked a not-insignificant portion of the largest, most shareholder-friendly public equity market right in their own back yard.

For some investors, the decision to bypass investing in ultra-small stocks is simply, “I don’t know where this goes in my portfolio.” This question is certainly appropriate, as investors should ask themselves what role every investment has in their portfolio. For those considering what role ultra-small stocks should play in their portfolio, we believe there are two approaches that are most appropriate: a liquid alternative to private equity or an extension of a small-cap allocation. While we believe there are many parallels with private equity, particularly when it comes to the size of these companies, for the sake of this piece, we’ve focused on how ultra-small stocks complement a broader small-cap portfolio.

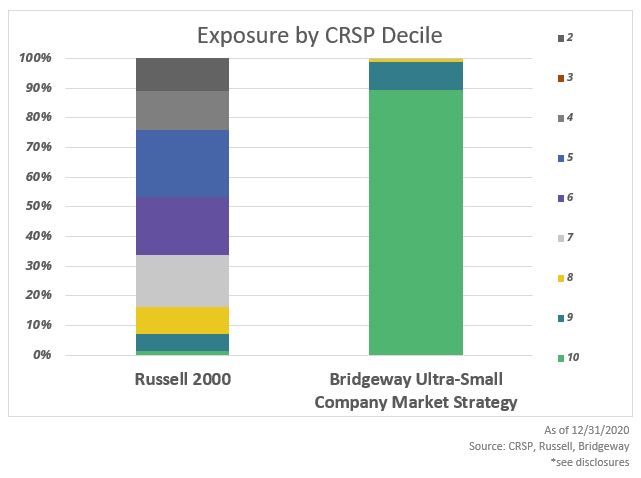

A “completion strategy” makes sense once we take a closer look at the composition of the Russell 2000 Index (“Russell 2000”), the benchmark for most investors’ US small-cap investments. As shown in the chart below, reviewing the Russell 2000 composition by CRSP decile reveals that CRSP 9 and 10—the smallest of small-cap stocks—have scant representation. In comparison, our Ultra-Small Company Market strategy is almost entirely allocated to the two smallest deciles.

Most investors allocate to small caps because they believe in diversification and the small-cap premium. Yet, many have overlooked one of the most historically robust segments of the US small-cap universe that contributes to that premium. Adding an ultra-small stocks sleeve to a typical Russell 2000 allocation simply fills out a small-cap portfolio and more comprehensively exposes those investments to that small-cap premium.

We would be remiss if we did not address another common objection we encounter when discussing investing in this sub-set of the market: liquidity. At a high level, this is a valid concern. For institutions with billions of dollars, investing in ultra-small companies can present liquidity challenges in terms of building or redeeming positions or being too large of a holder of an individual company. That said, we would point back to the private market investments we mentioned earlier. Institutions regularly allocate capital to private equity and then slowly (often over quarters or even years) see that capital called and put to work, then agreeing that those funds will be tied up for years; this is the very definition of illiquidity.

However, in our experience, even the largest investors could build out a portfolio of ultra-small stocks over the course of days or weeks (not quarters or years) without unduly moving markets or being too large of a stockholder. It would require a transparent conversation between investor and manager, with expectations and targets set accordingly. Certainly, a little patience would be required, too. However, as long-term investors, the “patient capital” should be able to withstand a minuscule amount of liquidity concerns particularly if they are already investing in inherently illiquid, seldom-priced strategies elsewhere across the portfolio.

In summary, we are optimistic about opportunities now in the ultra-small segment of the US equity market. Very likely, there are other attractive opportunities in the market; a casual look across the industry shows no shortage of investors considering allocations to distressed debt and real estate, to name a few. There may be some compelling stories in those parts of the market and others. However, we come back to one simple observation: How have US investors grown comfortable with increasingly complex, illiquid, and esoteric strategies without fully capitalizing on the full spectrum of the domestic equity market right in their own backyard?

For a PDF download of this thought piece, please use the following link:

Crisis and Opportunity: The Overlooked Role of Ultra-Small Stocks

DISCLOSURE

The opinions expressed here are exclusively those of Bridgeway Capital Management (“Bridgeway”). Information provided herein is educational in nature and for informational purposes only and should not be considered investment, legal, or tax advice.

Past performance is not indicative of future results.

Investing involves risk, including possible loss of principal. In addition, market turbulence and reduced liquidity in the markets may negatively affect many issuers, which could adversely affect the mutual funds. Value stocks as a group may be out of favor at times and underperform the overall equity market for long periods while the market concentrates on other types of stocks, such as “growth” stocks.

Diversification neither assures a profit nor guarantees against loss in a declining market.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. One cannot invest directly in an index.

The Center for Research in Security Prices (“CRSP”) US Stock Databases contain daily and monthly market and corporate action data for over 32,000 active and inactive securities with primary listings on the NYSE, NYSE American, NASDAQ, NYSE Arca and Bats exchanges and include CRSP broad market indexes. CRSP databases are characterized by their comprehensive corporate action information and highly accurate total return calculations.